- #Reverse mortgage calculator monthly payments code

- #Reverse mortgage calculator monthly payments free

When Does a Reverse Mortgage Make Sense? Financial Planning After 12 months, you may access your additional funds. With the other loan payment options (line of credit and monthly advances), this limitation is for the first year only. If you choose to go with the one-time lump sum disbursement at closing option to receive your loan proceeds, you are limited to 60 percent of the principal limit (the total amount of proceeds available to you as a HECM reverse mortgage borrower).

#Reverse mortgage calculator monthly payments free

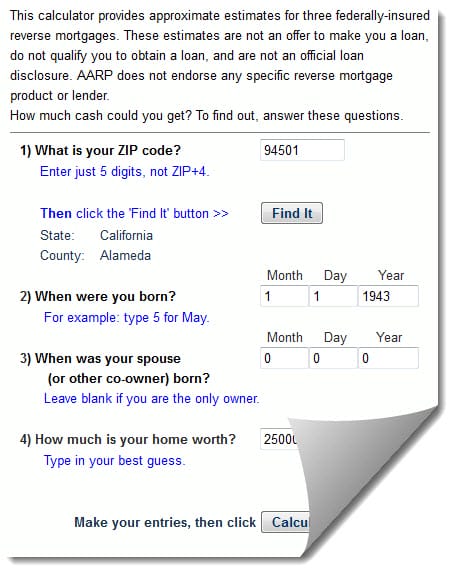

Use our free reverse mortgage calculator to determine how much equity you may qualify for.

With a HECM, the percentage of your home’s equity you can borrow depends on your age, the interest rate you get on your loan, and the value of your home up to the HECM limit (currently $1,089,300).

How Much Money Do You Get on a Reverse Mortgage? The borrower owns a home with a very high property value ($1 million+) and wants to access a larger percentage of the home’s equity (HECM initial disbursement limits are based on the appraised value of the home up to $1,089,300).The borrower lives in a non-FHA-approved condo.Here are some situations where a proprietary reverse mortgage may be a better fit for a borrower as compared to a HECM: There are a few proprietary products out there, and they tend to be similar to a HECM in many ways. These are called private or “proprietary” reverse mortgages. Over the last several years, there has been a rise in investor-owned reverse mortgage products. No personal information is required to see what you may qualify for. Note: You can use our free reverse mortgage calculator above to see what you may qualify for. Since a HECM is a non-recourse loan, when the loan matures and is due and payable, the FHA guarantees that neither the borrower nor their heirs will owe more than the home is worth at the time it is sold. The HECM loan balance usually becomes due and payable when the last surviving borrower permanently leaves the home.

So long as the borrower lives in the home and pays the property-related taxes, insurance, and upkeep expenses, the borrower can continue to defer repayment of the loan balance. Available to homeowners age 62 and older, it allows the borrower to convert a portion of their home equity into cash or a growing line of credit and defer repayment of the loan balance until a later date. The most common reverse mortgage is a Home Equity Conversion Mortgage (HECM), the only reverse mortgage insured by the Federal Housing Administration (FHA). What Are the Different Types of Reverse Mortgages? HECM Reverse Mortgages Learn more about how a Home Equity Conversion Mortgage (HECM) loan might be right for you by contacting one of our top reverse mortgage lenders. When researching a reverse mortgage, it’s important to speak to your family and trusted financial advisor to weigh both the pros and cons. If the calculator or company you are using to compare programs does not give you all this information and functionality, you are not getting access to all the information available and are deciding at a distinct disadvantage!įurthermore, you are not getting enough information to be able to compare and make an educated decision regarding the best option for you, especially if you want to compare several companies.

#Reverse mortgage calculator monthly payments code

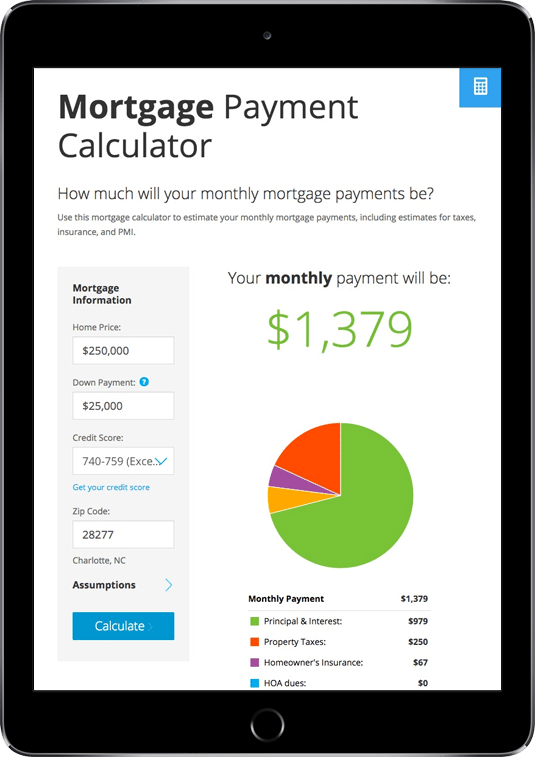

It must have the ability to retrieve and populate the local third-party costs (appraisal, title insurance, recording fees, etc.) based on the zip code you provide so that your proposal has the most accurate fees and costs possible. The calculator should be updated no less than daily and more often if needed. It should give you the information you are requesting and not withhold the loan option information, requiring you to either fill in your personal information (such as social security numbers and all your contact information including phone number) just so that you can get an idea of what is available to you.Īn effective calculator must allow you to see all options available and give you the opportunity to choose the option that best meets your needs.

0 kommentar(er)

0 kommentar(er)